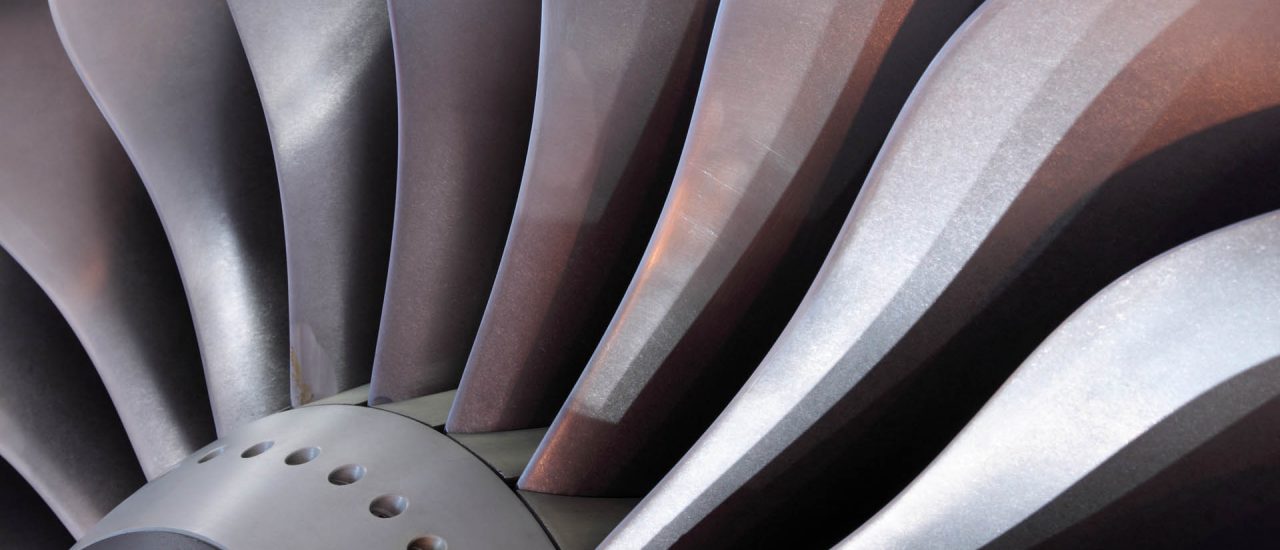

Aviation Hull Insurance

Aircraft hull insurance cover is designed to protect you (the Insured) against the physical loss of or damage to your aircraft, including engines and other fitted parts.

Insurers will undertake at their option, to pay for, replace, or repair physical loss of or damage to your aircraft, arising from the risks covered, up to an agreed value and subject to any deductible (an amount of money you will contribute to any claim).

In case your aircraft is damaged, Insurers have the option to arrange for it to be repaired and to cover the cost, to make you a payment or to pay for repairs carried out by you or to your order.

The risks covered are of the flight of aircraft, whilst the aircraft is on the ground or is taking off / landing / taxiing. Insurance coverage will also include the disappearance of the aircraft if it has been unreported following the start of the flight.

Your aircraft will be covered by Insurers on an ‘agreed value’ basis, which is an amount agreed by you and the Insurers at the time your starts. This will usually mean you will receive this amount, in the event of a total loss or a constructive total loss of your aircraft, regardless of the market value of your aircraft, at the date of the loss.

You will need to provide details to Insurers of your aircraft, such as the type, make and model, year of manufacture, the serial number and/or registration marks. The agreed value, as provided by you, will be subject to a deductible.

We will be happy to provide you with full details of coverage, terms, conditions, limitations and exclusions, upon request.

Aviation Spares Insurance

Under the insurance coverage for Aircraft Hull Insurance, aircraft will usually include engines and other parts, which are normally fitted as part of your aircraft.

Aircraft spares insurance coverage can include engines, spares and other equipment, which are destined to be installed on, or to form part of your aircraft, where this is your property, or where it is in your care, custody or control or that you have responsibility for it. This can also include engineers’ or mechanics’ tools used in connection with the servicing, maintenance or repair of aircraft.

Insurers will require a maximum sum insured for any one occurrence and they will also apply a deductible (an amount of money you will contribute to any claim).

Salvage charges will be paid by Insurers, at their consent, incurred by you for the recovery of your spares. These charges are usually payable in addition to any other claim under your insurance policy.

Your insurance policy, amongst other exclusions, will exclude loss or damage occurring after the commencement of the operation of fitting the property or placing it on board the aircraft for which it is destined. Your Policy will also exclude loss of or damage to any property fitted to or forming part of an aircraft, as well as any property, which has been detached from an aircraft, which is intended to be refitted and not replaced by other property. It is worth noting that wear and tear, deterioration, depreciation, breakdown defect or failure are also excluded from your Policy.

You are expected to keep a proper record of your Spares covered by the insurance policy, including their associated values.

Aircraft Liability Insurance:

Third parties

The aircraft liability insurance cover (third parties) protects you against liability to third parties, other than passengers, who might suffer damage or injury, including death, as a result of the operation of your aircraft.

Insurance coverage is provided for all sums which you shall become legally liable to pay as damages in respect of bodily injury, including death and damage to property, caused by your aircraft or by any person or object falling from your aircraft. It can also be possible to cover risks which do not solely relate to the operation of aircraft.

You suffer a loss, for the purposes of a third party liability policy, when loss or damage has been occasioned to a third party, for which you will be legally accountable. Hence the obligation of the Insurers to indemnify you will arise at that time, even though the precise extent of damages may not yet have been established.

Your insurance policy, amongst other exclusions, will not cover claims directly or indirectly occasioned by noise (whether audible to the human ear or not), vibration, sonic boom and associated phenomena unless caused by or resulting in a crash, fire, explosion or a recorded in-flight emergency, necessitating abnormal operation of the aircraft.

It is possible to provide you with insurance coverage against damage caused by noise and associated phenomena, if this would interest you, please let us know.

Insurers will require a limit to their liability, but this would comply with local law requirements and international requirements, such as the Montreal Convention.

For more details about combined limits, please see the Aircraft Liability insurance (passengers) section.

Aircraft Liability Insurance:

Passengers

The aircraft liability insurance coverage (passengers), protects you against your legal liability to passengers.

Insurance coverage is provided for accidental bodily injury, including death, to passengers, while they enter, whilst on board, or exit your aircraft. We can also arrange insurance cover for loss of or damage to your passengers baggage and personal articles.

Insurers will indemnity you in respect of all sums which you shall become legally liable to pay as compensatory damages in respect of accidental bodily injury, including death, while passengers enter, are on board, or exit your aircraft. Insurers require a limit to their liability, but this would comply with the Montreal Convention and other air travel requirements.

Your insurance policy will indicate Insurers’ limits payable in respect of passenger liability claims. These limits can be expressed as an amount per passenger seat for each accident or occurrence. This may also include a maximum aggregate limit each accident or occurrence.

Where passenger liability coverage is included with Aircraft liability for third party coverage, a combined single limit is usually applied by your Insurer, which will place a maximum single limit of indemnity for both third parties and passengers.

Passengers are generally understood to mean a person who rides or travels in your aircraft, who does not perform any duties associated with the operation of your aircraft. However, your pilots and operational crew can be covered, as required.

Your insurance cover for passengers may be conditional upon you taking measurers as are necessary to exclude or limit your liability, to the extent as permitted by law, before a passenger boards your aircraft, and if these measures include the issue of a passenger ticket or a baggage check , this must be delivered correctly and completed to the passenger a reasonable time prior to the passenger boarding your aircraft. If you do not comply with this condition, your policy may provide that the limit of indemnity for which Insurers will be responsible will not exceed the amount of legal liability, if any, that would have existed had the condition been complied with. It is worth noting that under the Montreal Convention, the conditions and limits of the Convention apply, even if you don’t deliver a suitable document of carriage.

Questions? Contact our expert team:

[email protected] or call +66 2 670 3902

Other types of aviation insurance

If you are interested in Aircraft Hull, Spares and Liability Insurance and Reinsurance then you may also be looking for the following kinds of insurance.